colorado estate tax threshold

Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as of the January 1 assessment date. For this the first 225000 of the decedents estate goes to the spouse as well as half of the balance.

Colorado Estate Tax Everything You Need To Know Smartasset

EITC is available for lower-income households currently the limits are about 21000 for a single filer or 54000 for a family with two.

. In general a C corporation must remit Colorado estimated tax payments if its net Colorado tax liability for the tax year exceeds 5000. But if its the decedent who has children from a past relationship the spouses share drops to the estates first 150000 and half the balance according to. In its first fifty years the state income tax had graduated rates where higher income earners were subject to higher tax rates than lower income earners.

A federal estate tax return can be. You have a Colorado income tax liability for the year. The answer is undoubtedly because it is cheaper and quicker.

For 2020 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 1158 million. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income. Marsha dies in colorado owning the following assets.

This Part 8 discusses the calculation of required quarterly estimated payments the remittance of estimated payments and the estimated tax penalty imposed for failure to remit required estimated payments. However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020 117 million for 2021 and 1206 million in 2022. The taxpayer was a full-year resident for the preceding tax year which consisted of 12 months and the taxpayer had no net Colorado tax liability for that tax year.

A nonresident of Colorado with Colorado source income AND. No estate tax or inheritance tax Connecticut. All retail sales are considered for the purpose of the 100000 threshold regardless of whether those sales would.

The taxpayers net Colorado tax liability minus all credits withholding and any sales tax refund is less than 1000. The phase out of the state estate tax credit eliminated estate taxes for many states. Note however that the estate tax is only applied when assets exceed a given threshold.

With a small estate probate assets can simply be collected by obtaining what is called a small estate affidavit. May increase with cost of living adjustments. Estate tax of 16 percent on estates above 5 million.

Colorado has no estate tax for decedents whose date of death is on or after January 1 2005. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. Federal exemption for deaths on or after January 1 2023.

The federal credit for state death taxes table has a tax rate of 0 for the first 40000. Land homes buildings etc and the decedents personal property must be less than 66000. Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment.

Estate tax can be applied at both the federal and state level. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. However if you are filing an Individual Income Tax Return DR 0104 on behalf of a recently deceased taxpayer visit the Deceased Taxpayer web page.

The state of Colorados single largest source of revenue the individual income tax was enacted in 1937. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. The department will consider among other things.

For 2015 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 543 million. For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple. Most simple estates such as cash or a small amount of easily valued assets do not require the filing of an estate tax return.

You are required to file a federal income tax return or. To qualify for a small estate probate in Colorado the estate must not contain any real property ie. For 2021 this amount is 117 million or 234 million for married couples.

A federal estate tax return can be filed using Form 706. Unlike the federal income tax colorados state income tax does not provide couples filing jointly with expanded income tax brackets. A Colorado resident is a person who has made a home in Colorado or a person whose intention is to be a Colorado resident.

13 rows Even though there is no estate tax in Colorado you may still owe the federal estate tax. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. It taxes the entire amount of the estate on estates over that 1 million threshold.

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. If the estate or trust receives income a fiduciary income tax return must be filed. However not many states have an estate tax.

Currently about a quarter of states collect an estate tax. 1 Most individuals and non-corporate businesses are subject to the tax. The state of Colorado for example does not levy its own estate tax.

For information on how to file a Fiduciary Income Tax Return DR 0105 visit the Filing Information web page.

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

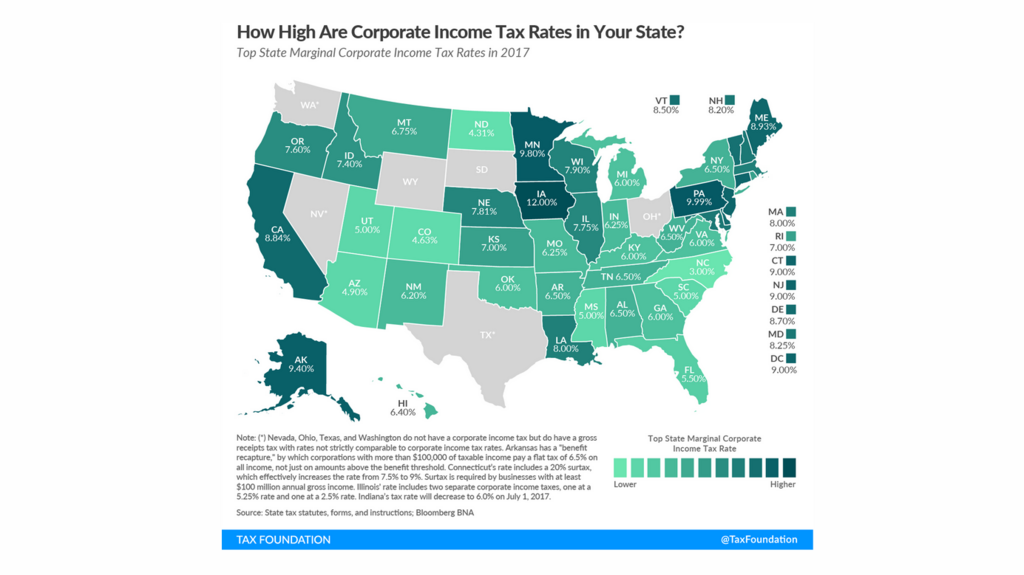

Colorado Goes Easy On Corporate Income Taxes Denver Business Journal

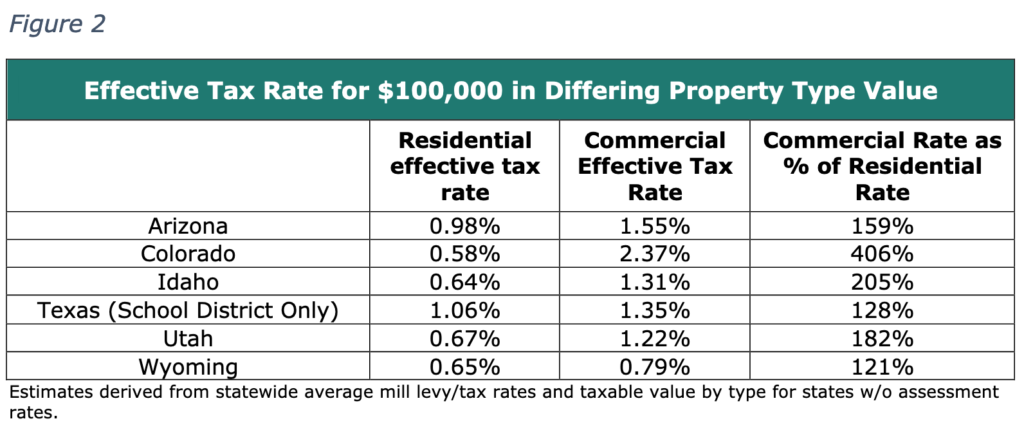

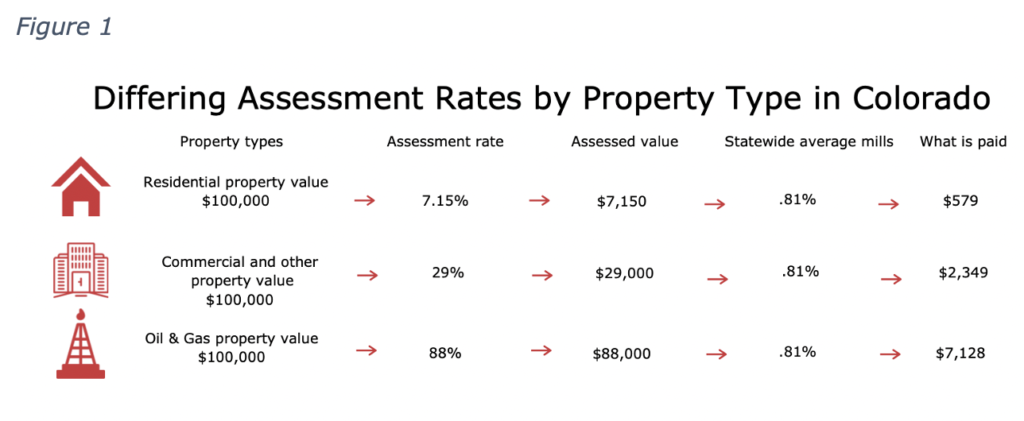

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Historical Colorado Tax Policy Information Ballotpedia

Colorado Estate Tax Everything You Need To Know Smartasset

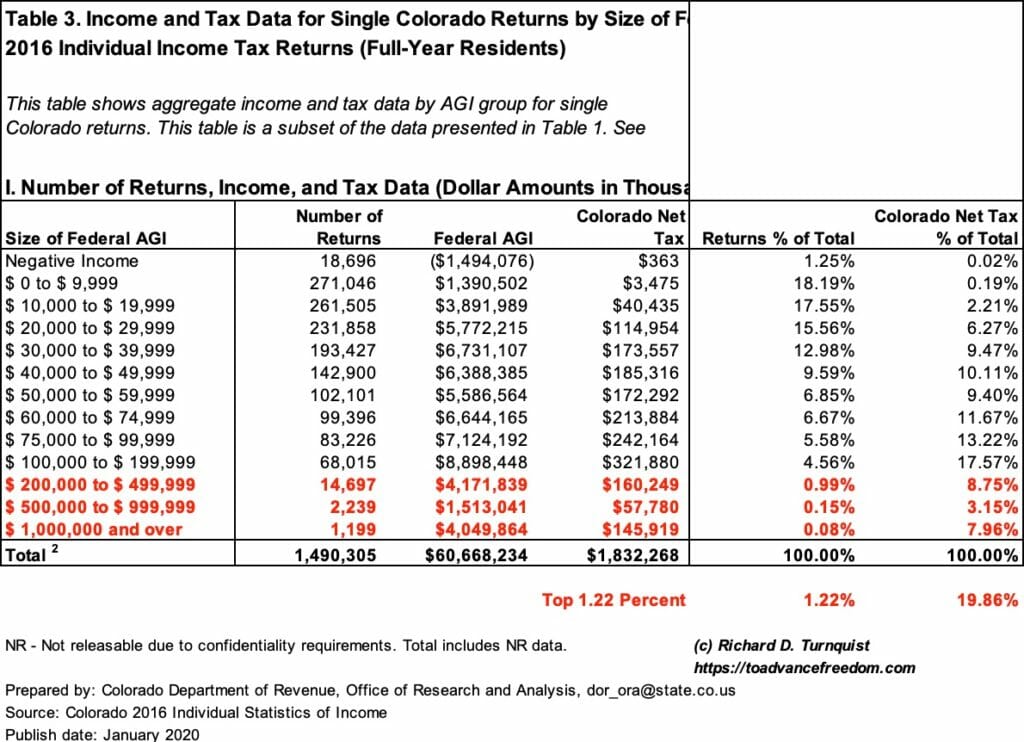

Punishing Success The Kim Monson Show

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

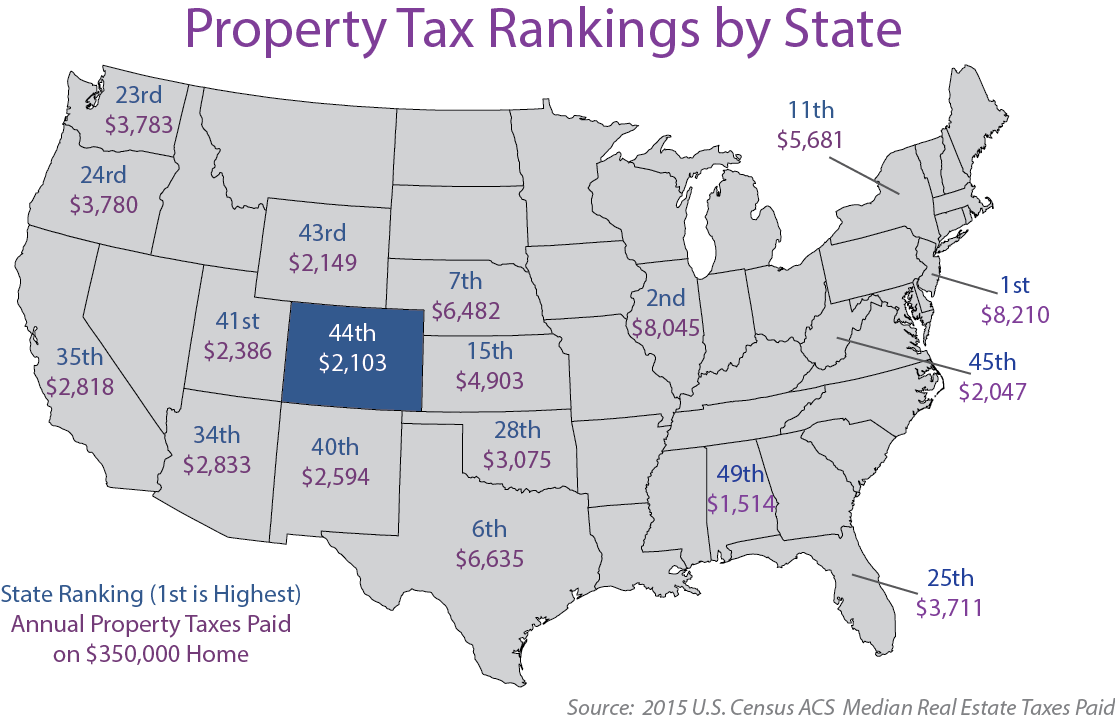

How Does Your State Compare In Property Taxes

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Colorado Is The 3 State With The Lowest Property Taxes Stacker

Colorado S Low Property Taxes Colorado Fiscal Institute

Who Pays The Highest Property Taxes Property Tax Real Estate Staging Denver Real Estate

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Clark Howard Retirement Life Map

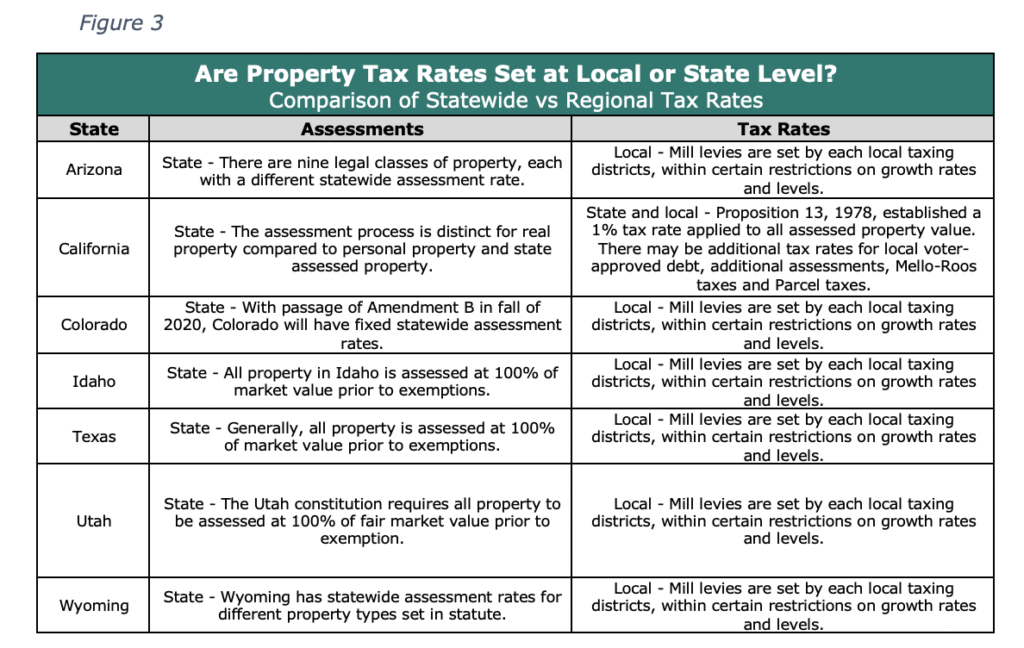

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Estate Tax Everything You Need To Know Smartasset

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals Faegre Drinker Biddle Reath Llp Jdsupra